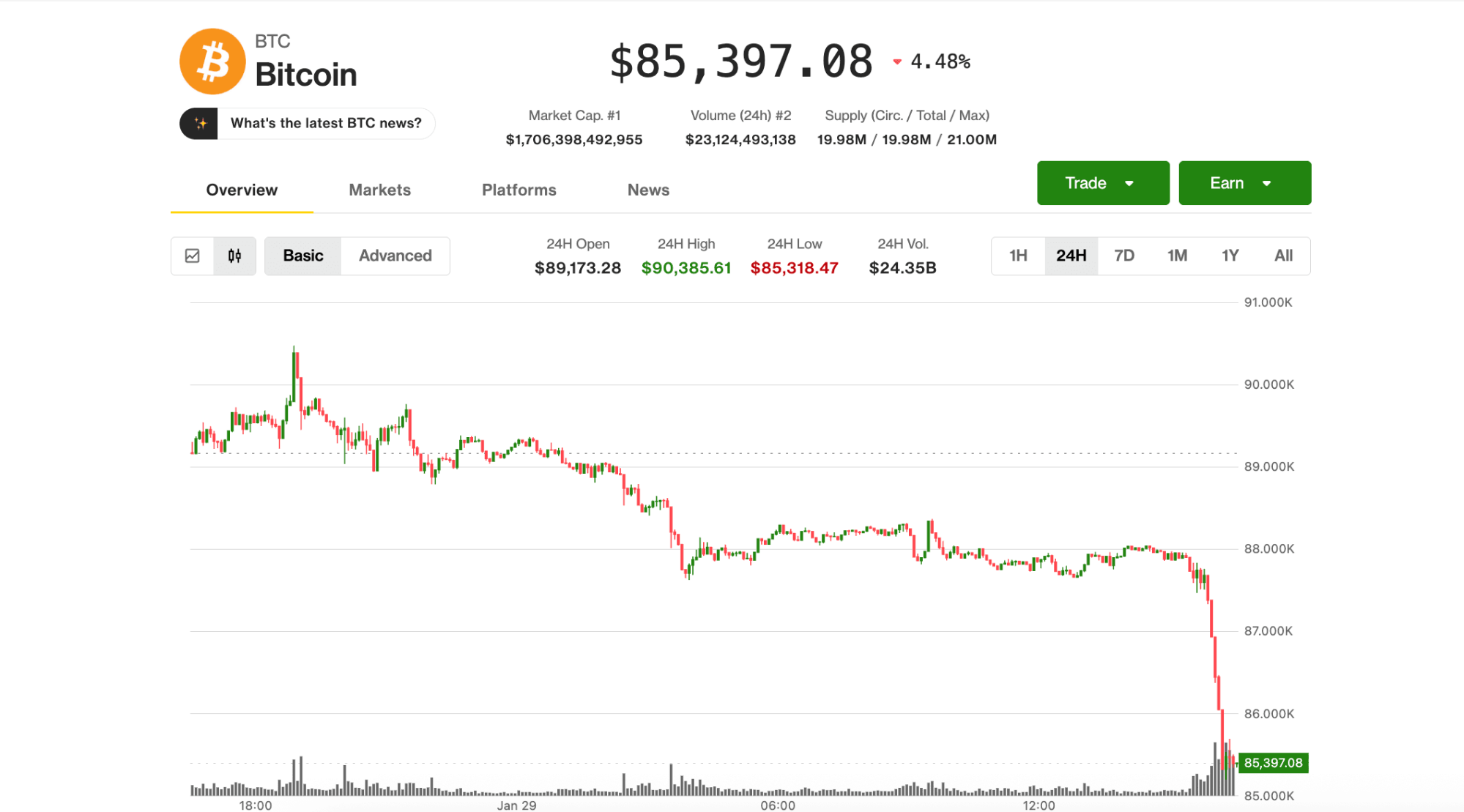

Crypto markets endured a brutal session on January 29, 2026, with Bitcoin (BTC) crashing to its lowest level of the year at approximately $85,200 (intraday lows confirmed between $84,338 and $85,360 across major exchanges and CME futures data). The drop erased roughly $3,000 in hours, pushing BTC down ~4.5% over the past 24 hours and marking the weakest performance since mid-December 2025.

This sharp decline was part of a broader risk-off avalanche that swept through global financial markets, triggered by a dramatic reversal in gold prices, disappointing earnings from Microsoft (MSFT), and renewed strength in the U.S. dollar. Altcoins suffered even steeper losses, crypto-related stocks cratered, and volatility indicators spiked — creating a textbook environment for high-leverage traders who know how to navigate chaos.

The Perfect Storm: What Drove Today’s Selloff

- Gold’s Spectacular Reversal

Gold futures briefly touched an unprecedented $5,600+ per ounce early Thursday — a level never seen before in history — fueled by persistent inflation fears, geopolitical tensions, and safe-haven buying. But the rally collapsed almost as quickly as it rose: within minutes during U.S. morning trade, spot gold plunged nearly 10%, falling below $5,200/oz (trading in the $5,149–$5,200 range per Reuters and Bloomberg terminals). Silver mirrored the move, dropping from $121/oz to $108/oz. This violent unwind in precious metals removed one of the key narrative supports for Bitcoin’s “digital gold” thesis. When traditional safe havens falter after parabolic runs, risk assets — including BTC — often face correlated liquidations. - Microsoft Earnings Miss Sparks Tech Rout

The Nasdaq Composite fell ~1.5%, its sharpest daily drop in weeks, largely due to Microsoft (MSFT) shares collapsing more than 11% — potentially its worst single-day performance since March 2020. The tech giant reported fourth-quarter fiscal 2026 results that beat EPS estimates ($4.14 vs. $4.09 expected) but disappointed on cloud growth (Azure revenue up 30% YoY, below expectations) and issued cautious guidance on AI infrastructure spending amid rising energy costs and competitive pressures. Microsoft’s stumble dragged the entire Magnificent 7 and broader tech sector lower, reinforcing BTC’s current tight correlation with risk-on equities rather than decoupling as a true safe haven. - Dollar Strength & Volatility Spike

The U.S. Dollar Index (DXY) rebounded sharply from Wednesday’s low of 95.5 to 96.6, putting renewed pressure on dollar-denominated risk assets. At the same time, the CBOE Volatility Index (VIX) surged more than 16% to 19 — its second-highest reading since late November — signaling heightened fear and forced de-risking across portfolios.

Crypto Market Fallout: Altcoins Hit Hardest

Bitcoin’s drop was painful, but altcoins bore the brunt:

- Ethereum (ETH): ~$2,815 (down 5–6%)

- Solana (SOL): ~$118 (down 5–6%)

- Dogecoin (DOGE): ~$0.1167 (down 5–6%)

- Cardano (ADA): ~$0.3347 (down 5–6%)

Crypto equities followed suit:

- MicroStrategy (MSTR) — the largest corporate BTC holder — plunged ~8%, hitting 52-week lows and retreating to September 2024 levels.

- Coinbase (COIN), Circle (CRCL), Bullish (BLSH), and Twenty One Capital (XXI) all declined 4–8%.

On-chain data shows more than half of BTC supply now sits underwater relative to cost basis above $88,000, triggering panic selling and cascading liquidations that amplified the move.

Technical & Macro Context: Where BTC Stands Now

- Support Levels: Immediate support lies at $84,000–$85,000 (mid-December 2025 lows). A break below could target $80,000–$82,000 (psychological and previous swing lows).

- Resistance: Any bounce faces heavy overhead at $88,000 (recent breakdown level) and $90,000–$92,000 (prior consolidation zone).

- Options & Derivatives Impact: Gamma exposure from recent expiries and dealer positioning likely contributed to accelerated downside momentum.

- Macro Overlay: Rising DXY, spiking VIX, and tech earnings weakness point to continued risk aversion. Gold’s reversal removes the “flight to safety” narrative that occasionally buoys BTC during equity selloffs.

Trading Opportunities in the Chaos – Wallstreet Queen Official Perspective

Volatility like today is exactly where high-leverage traders thrive. At Wallstreet Queen Official, we consistently profit in both directions:

- Recent highlights include 123.35% on EGLD/USDT short (3.5 hours), 118.75% on GALA/USDT short (<4 hours), 15.10% on UNI/USDT short (under 3 hours), and multiple 70–120%+ longs during pumps.

- Today’s environment favors short-biased setups near resistance or quick scalp longs on oversold bounces — always with tight stops and 20x–75x cross leverage for maximum reward/risk.

We’re actively monitoring:

- BTC/USDT order flow and liquidation heatmaps

- ETF inflows/outflows (spot BTC ETFs seeing outflows amid risk-off)

- Options open interest for potential gamma squeezes

- Macro catalysts (Fed speakers, Treasury yields, next earnings wave)

Whether this is a healthy correction in a broader bull market or the start of deeper capitulation, precision execution wins. Our VIP members get real-time alerts, detailed chart analysis, exact entry/exit levels, and community discussion on every major move.

Final Thoughts: Patience & Discipline in 2026’s Volatile Landscape

Bitcoin’s correlation to equities remains strong, and today reminded us that “digital gold” decoupling is not yet complete. Gold’s reversal and Microsoft’s stumble exposed vulnerabilities, but BTC’s long-term scarcity, institutional adoption (ETF flows, corporate treasuries), and maturing derivatives markets still provide a bullish foundation once panic subsides.

Markets reward those who stay calm, manage risk, and strike when setups align. Don’t chase — wait for confirmation.

Ready to turn volatility into profits? Join our VIP channel for elite leverage signals, live commentary, and the edge you need in 2026’s fast-moving crypto world.

👉 Join WallstreetQueenOfficialAdmin now!

Disclaimer: Cryptocurrency trading involves substantial risk of loss and is not suitable for all investors. This is not financial advice — always conduct your own research (DYOR), use proper risk management, and consult professionals before trading. 🚀📉💰

Leave a Reply