When it comes to cryptocurrency trading, market sentiment plays a crucial role. Emotions like fear and greed can drive price movements just as much as technical and fundamental factors. That’s where the Crypto Greed and Fear Index comes in—it provides a snapshot of investor sentiment, helping traders make more informed decisions.

At Wallstreet Queen Official, we believe in empowering traders with the right tools and insights to navigate the volatile crypto market. In this guide, we’ll break down the Crypto Fear and Greed Index, explain how it works, and show you how to use it effectively in your trading strategy.

What Is the Crypto Fear and Greed Index?

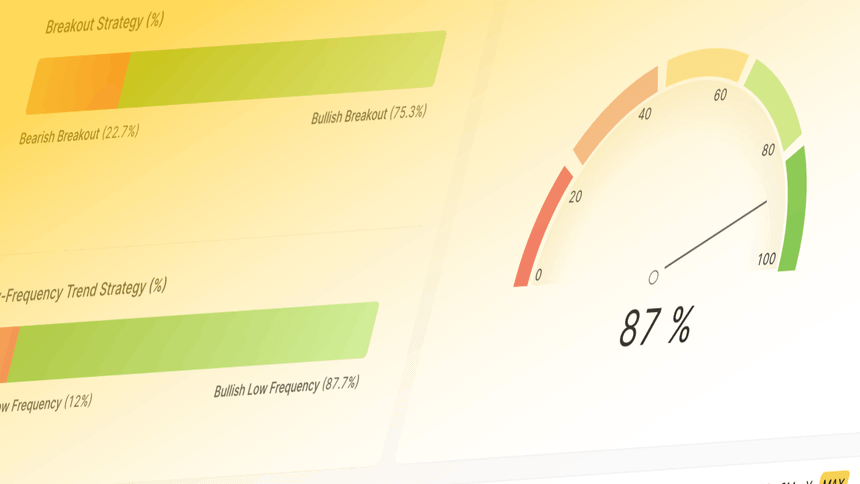

Originally designed for the stock market, the Fear and Greed Index was later adapted for cryptocurrency to reflect the emotional state of crypto investors. It measures market sentiment on a scale of 0 to 100, where:

- 0-24 (Extreme Fear): Indicates panic and potential market bottoms.

- 25-49 (Fear): Signals caution but potential buying opportunities.

- 50 (Neutral): Market sentiment is balanced.

- 51-74 (Greed): Investors are becoming too optimistic.

- 75-100 (Extreme Greed): Indicates overconfidence and potential corrections.

Understanding this index can help traders determine whether the market is overbought or oversold and adjust their strategies accordingly.

How Is the Crypto Fear and Greed Index Calculated?

The index is determined using six key metrics:

- Volatility (25%) – Measures how much Bitcoin’s price fluctuates compared to historical averages. Higher volatility often signals fear.

- Market Momentum/Volume (25%) – High trading volumes in a rising market suggest greed, while low volumes indicate fear.

- Social Media (15%) – Analyzes Twitter mentions, hashtags, and engagement to gauge crypto popularity.

- Surveys (15%) – Weekly polls provide direct insight into investor sentiment.

- Dominance (10%) – If Bitcoin dominance increases, it suggests fear (investors seeking safety). A decrease indicates greed (more interest in altcoins).

- Google Trends (10%) – Tracks search volume for crypto-related terms to assess market interest.

These metrics are combined to produce a daily sentiment score, helping traders identify potential market reversals.

Why Should You Track the Fear and Greed Index?

1. Identifying Market Reversals

Extreme greed can indicate an upcoming price correction, while extreme fear might suggest a buying opportunity. Smart traders use the index to time their entries and exits effectively.

2. Managing Emotional Trading

By following a data-driven index rather than reacting emotionally, traders can avoid panic selling or fear-of-missing-out (FOMO) purchases.

3. Enhancing Risk Management

If the index shows extreme greed, it may be time to secure profits or set stop-loss orders. Conversely, extreme fear might warrant accumulating assets at lower prices.

Using the Crypto Fear and Greed Index in Your Strategy

1. Don’t Rely Solely on the Index

While the index is a useful tool, it should be used alongside technical and fundamental analysis.

2. Automate Your Trading

Platforms like TradingView automated trading allow traders to set predefined rules based on the index to execute trades automatically.

3. Consider Copy Trading

If you’re unsure about how to interpret the index, consider using copy trading, where you follow experienced traders’ strategies.

4. Use Trading Bots

AI-driven crypto trading bots can execute trades without emotional bias, making them a great option during high volatility.

Final Thoughts: Should You Use the Crypto Fear and Greed Index?

Absolutely! While it’s not a crystal ball, the Fear and Greed Index is a valuable tool that can give traders an edge in the market. By tracking sentiment trends, traders can spot potential market shifts before they happen.

At Wallstreet Queen Official, we encourage traders to stay informed, use multiple data sources, and develop a well-rounded trading strategy. Follow us for more expert insights and updates on the crypto market!

Are you using the Fear and Greed Index in your trading? Let us know in the comments!

Stay Ahead with Wallstreet Queen Official

For daily crypto analysis, trading tips, and the latest market trends, follow Wallstreet Queen Official on [social media channels] and subscribe to our newsletter!

Leave a Reply